Canada Post Update: Rotating strikes are in effect. Delays expected.

Access statements & services digitally. Click for help and guidance.

Accounts

Chequing

Smart Chequing for Everyday Banking

Whether you're looking for unlimited digital banking with no monthly fees or a low-cost option with added flexibility, our chequing accounts are designed to keep banking simple, secure, and accessible.

No-Fee eChequing*

No Monthly Account Fees

- No monthly fee; No minimum balance required

- FREE, unlimited day-to-day transactions1

- FREE, unlimited Interac® e-Transfers

- Award-winning No-Fee eChequing Account

- Access to over 3,300 ATMs in THE EXCHANGE® Network - Canada's largest ATM network, surcharge-free! In the United States, access 40,000 surcharge-free ATM’s through the Allpoint Network.

No Minimum Balance

- Safe and secure – eligible deposits are insured up to the maximum amount through the Canada Deposit Insurance Corporation (CDIC)

- 0.05%** Annual Interest Rate.

Basic Chequing^

$4/month fee2

- 20 day-to-day transactions included monthly3

- FREE digital statements and cheque images

- Cheque writing privileges included

- NO FEES for:

- Deposits

- Debit card transactions

- ATM withdrawals (within our network)

- Pre-authorized payments

- Access to over 3,300 ATMs in THE EXCHANGE® Network - Canada's largest ATM network, surcharge-free! In the United States, access 40,000 surcharge-free ATM’s through the Allpoint Network.

No Minimum Balance

- Safe and secure – eligible deposits are insured up to the maximum amount through the Canada Deposit Insurance Corporation (CDIC)

Information

We make banking easy, accessible, and secure - wherever you are.

ONLINE BANKING

Bank 24 hours a day, 7 days a week. Pay your bills online and skip that trip to a mailbox or bank branch.

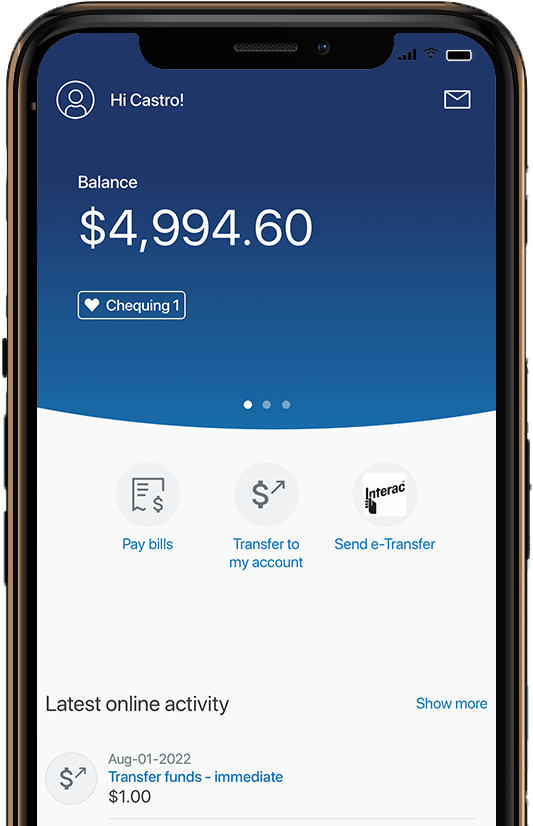

MOBILE

Get the full experience of online banking plus more. Whether you're checking your balances or depositing your cheques easily with Deposit Anywhere™, do it all within your fingertips.

At Alterna, our members always come first. We’ve always believed that being upfront and honest is the most respectful way to provide important information. That’s why everything you need to know about our current service fees and account features can be found here:

Get your bank accounts talking to each other with a few clicks.

Available with your Alterna Bank account, External Account Transfer is a free feature that lets you link all your accounts from different financial institutions so you can transfer funds with ease.

-

-

Transfer funds to and from your account to another financial institution

-

Fund new accounts from your external account if other financial institutions support it

-

Setting up is easy! Find out more on External Account Transfer.

Overdraft Protection

Add overdraft protection to your Alterna chequing account and enjoy the peace of mind of knowing you’ll have access to extra funds when you need them. No longer worry about your account becoming overdrawn if you accidentally don’t have enough money in your account to clear outstanding cheques, pre-authorized debits and debit card transactions. Your overdraft protection will automatically come into effect to cover any shortfall up to your approved overdraft limit.

- Repayment is as easy as making a deposit to your account

- Low monthly fee of $2.504

- Annual interest rate of 19.99%

- Covers all draws on your chequing account (bill payments, cheques, point of sale, pre-authorized debits, etc.)

- Credit limits ranging from $500 to $5,0005

- Application is subject to credit approval

Get peace of mind – activate overdraft protection in digital banking now

*eChequing Accounts and rates are only available for purchase online.

^Offered as part of the Commitment on Low-Cost and No-Cost Accounts from the Financial Consumer Agency of Canada (FCAC) across Agency branches only.

**Interest rate is annualized and subject to change without notice. Interest is calculated daily on the closing balance and paid monthly. $1,000,000 maximum balance (plus accrued interest).

1Includes: Withdrawals, Transfers, Interac® e-Transfers, Me-to-Me Transfers, Bill Payments, Cheques, Pre-authorized payments, Debit card payments (POS), Alterna and THE EXCHANGE Network ATM withdrawals and transfers.

2Fee waived for seniors receiving GIS, RDSP beneficiaries, youth, students, and newcomers to Canada.

3Includes: In-branch withdrawal/transfer, cheque writing, pre-authorized payments/debit (PAP/PAD), Interac® e-Transfers, Bill Payments, External account Transfers, Alterna and THE EXCHANGE Network ATM withdrawals and transfers, ACCEL® and Maestro® Debit Payment (US & International)

4Overdraft protection fee is not applicable to Quebec residents. Overdraft fees are in addition to interest charges on the outstanding overdraft amount. Interest will be calculated and debited monthly to your account based on the final daily indebtedness in the account throughout the calendar month. Interest rates set by Alterna Bank will apply both before and after the Overdraft Protection service is terminated, and before and after judgment is obtained against you.

5Applications via digital banking have a maximum limit of $1,500.

Maximum balance per customer is $250,000 (plus accrued interest).

Click here for our FAQs on Account Limits.

CS Alterna Bank is a member of Canada Deposit Insurance Corporation (CDIC).

We are here for you.

Welcome to client centered banking and award-winning service, products and total transparency that truly puts the good in banking.

Stay in touch. Be the first to know about news, promotions and announcements. Signup Now!